Interest only mortgage calculator with additional payments

Pay off your 400000 30-year mortgage in a little over 25 years and save over 36000 in mortgage interest by making 200 additional payments. This tool helps buyers calculate current interest-only payments but most interest-only loans are adjustable rate mortgages.

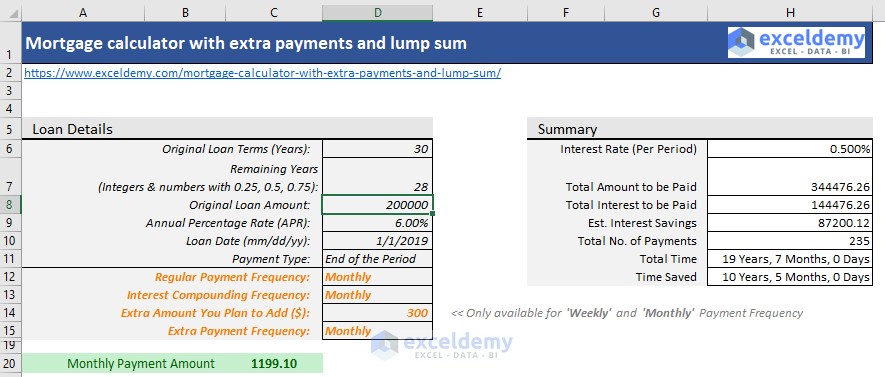

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments.

. For those on fixed rate mortgages youre only likely to see a change in your payments once you reach the end of your current deal. The Retirement Interest Only Mortgage sometimes called a RIO Mortgage is available to people over 55. You can also see the savings from prepaying your mortgage using 3 different methods.

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. LA IR 12 ITMP. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise.

There are also optional factors available for consideration such as the tax on interest income and inflation. Using our mortgage rate calculator with PMI taxes and insurance. The final word Ultimately mortgage calculators ensure that borrowers are more informed when it comes to the financial side of purchasing a home and enable home buyers to make the choices that are.

After that period youll need to pay principal and interest which means your payments will be significantly higher. Our interest only guide will help you estimate your interest only mortgage payments. Mortgage calculators can help you to include these additional factors when youre determining the necessary monthly payments for your new home.

To figure out your interest-only payments simply follow this formula. You need to be aware that an interest-only loan presents some additional risk compared with a conventional fixed. As your principal balance is paid down through monthly or additional payments the amount you pay in interest decreases.

Additional loan options are listed in the drop down filter area. The Bankrate loan interest calculator can help you determine the total interest over the life of your loan and the average monthly interest payments. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments.

A good mortgage calculator factors in not only principal and interest but also additional home costs like taxes home insurance private mortgage insurance and homeowners association dues. Our Interest Calculator can help determine the interest payments and final balances on not only fixed principal amounts but also additional periodic contributions. Mortgage calculator - calculate payments see amortization and compare loans.

Looking for an interest-only mortgage calculator. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low.

Assuming the above scenario youll pay off your 400000 in a little over 25 years and perhaps the best part youll save over 36000 in mortgage interest charges. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Our interest only mortgage repayment calculator can give you a good idea of how much additional interest you might have to pay but you should speak to your lender to confirm this.

Because interest payments on your primary residence are tax-deductible for loans up to 750000 100 percent of your interest-only mortgage is tax-deductible if you itemize. Formula to calculate your monthly mortgage payments. Additional expenses such as homeowners association HOA fees closing costs property taxes and homeowners insurance should be factored in with your monthly housing expenses.

While our calculator takes the computing out of your hands math whizzes can do it themselves with the following. For example a 4 interest rate on a 200000 mortgage balance would add around 652 to your monthly payment. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment.

Whatever the frequency your future self will thank you. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. A 30-year fixed-rate mortgage is the traditional loan choice for most homebuyers.

Your interest rate is typically represented as an annual percentage of your remaining loan balance. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. This calculator only applies to loans with.

Paying an Interest-Only Mortgage. Its a loan secured against your home. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

In addition to making extra payments another great way to save money is to lock-in historically low interest rates. Make more frequent payments. For example if youre paying 1250 dollars a month on a 15-year 180000 loan you would start by multiplying 1250 by 15 to get 225000.

The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. Then subtract the principal amount from that number to get your mortgage interest. You pay the interest each month which means the amount you owe doesnt increase over time.

To calculate mortgage interest start by multiplying your monthly payment by the total number of payments youll make. You can make principal payments during the interest-only period but youre not required to. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule.

Building a Safety Buffer by Making Extra Payments.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

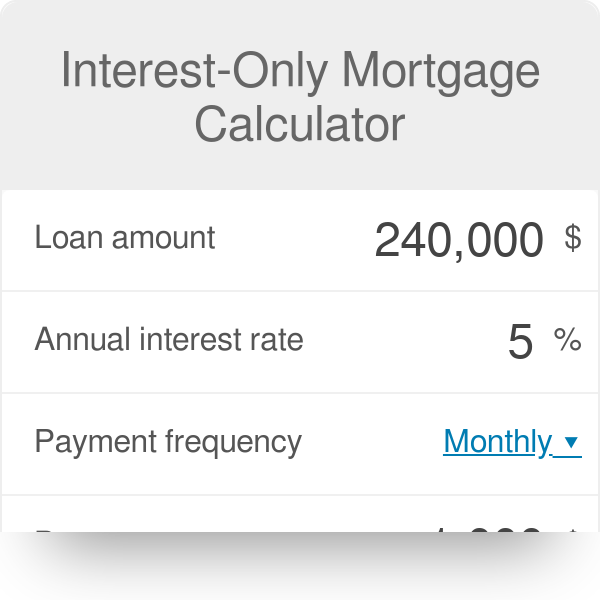

Interest Only Mortgage Calculator

Balloon Loan Calculator Single Or Multiple Extra Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Extra Payment Mortgage Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Repayment Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Payoff Calculator With Line Of Credit

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Free Interest Only Loan Calculator For Excel

Interest Only Mortgage Calculator With Additional Payments